What is Cash Against Documents (CAD)?

Cash against documents (CAD) is a phrase that you’ll often hear when dealing with importing or exporting goods. When doing business internationally, it can be very difficult to protect one’s interests in a transaction. This is where CAD payment terms can be beneficial

CAD is a is a method of doing business that is used when doing business internationally because it can be difficult to resolve disputes after the fact. Cash against documents payment terms can alleviate potential problems.

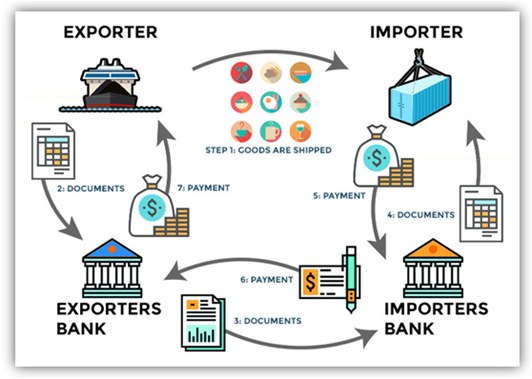

A third party is utilized (usually a bank) to act as an intermediary or uninterested party in the transaction. The bank’s role is to hold the shipment documents (invoice, bill of lading, import papers) until the buyer submits payment. During this process, the exporter retains ownership of the goods until the documents are released to the buyer.

Cash Against Documents Process

The process is fast and time effective. It begins with a contract/transaction being closed between the buyer and seller. Once the goods are shipped, the documents are sent to the remitting bank, which then sends them to the client’s bank. The client’s bank then holds documents against payment.

When the payment is made it is sent to the shipper’s bank, and the shipping documents are released which allows the importer to take possession of the goods

CAD Transaction Costs

The cost of CAD transactions is often minimal compared to the value it provides during a transaction. The original purchase agreement will usually state which party (buyer or seller) is responsible for paying the applicable cash against documents costs to the bank. It is common to see both parties split the cost.

Advantages

There are some notable advantages that come along with using cash against documents during international transactions. They include:

Low cost for both parties

No bank credit line is needed

Fast and easy to use and implement

The bank does not control the documents such as in a documentary credit situation

Disadvantages

There are of course some disadvantages to using CAD procedures. They include:

No assurance that buyer will ultimately pay to close the transaction

Seller may have to absorb additional shipping costs if goods are refused

Improper bank procedures causing documents to prematurely be delivered to the buyer

The Bottom Line

Cash against documents, otherwise know as CAD or documents against delivery, is a method used during international transactions. It involves the use of an intermediary to protect both parties interests. It’s a relatively simple process that is cost effective and easy to implement